Nothing strikes fear and intimidates more than red ink. In fact, no other color elicits quite the same response. Perhaps this reaction stems from seeing correction marks in red ink. Over the years you become conditioned to those red marks. Red becomes a color that indicates something is wrong or needs attention. You can’t ignore it. In the case of the Medicare personal liability settlement Red Letter that your client may receive, this couldn’t be truer. If or when your client receives this letter, it won’t just need attention, it will demand it. In fact, it demands it now. And here’s why.

Imagine This Scenario

You’ve settled a liability case for a client. Not just any client, but one who’s not Medicare eligible at the time of settlement. Meaning there’s no reason for the defendants or their insurers to report this case to Medicare. The Section 111 law of 2007 requires that defendants, self-insured or other responsible entities report settlements to Medicare. But, there’s more. They are motivated to report. Failure to report a Medicare-eligible beneficiary’s liability settlement to Medicare means a $1,000 per day, per claimant penalty. We’ll cover more about this law, and its effects, later. For now, back to our scenario.

Had your client been Medicare eligible? Reporting would have meant disclosing ICD-9 or ICD-10 disease codes. These codes describe the injuries or conditions that are settled as part of the case. When these are reported to Medicare, they are filed away. Saved to match up against future bills submitted to Medicare. A match means payment is denied, and falls to your client to pay.

Some casualty adjusters have disclosed that their firm reports all settlements to the government. Medicare eligible or not. What happens with non-eligible reports? No answer has come from Medicare yet. However, we live in an age where tracking of all of our tweets, emails and phone calls is the norm. This certainly suggests that Medicare could store this info for later. Yet, it appears that you and your client are in the clear. As, in our example, your client isn’t Medicare eligible at the time of settlement. Right?

This is true. Until it’s not. When your client becomes Medicare eligible post settlement. At this point, Medicare will send them a SECONDARY CLAIM DEVELOPMENT (SCA) Red Letter. This letter includes a three section questionnaire. The second section, “More Information About You,” being the most alarming of them all.

The Ins & Outs Of The Medicare Personal Liability Settlement Red Letter

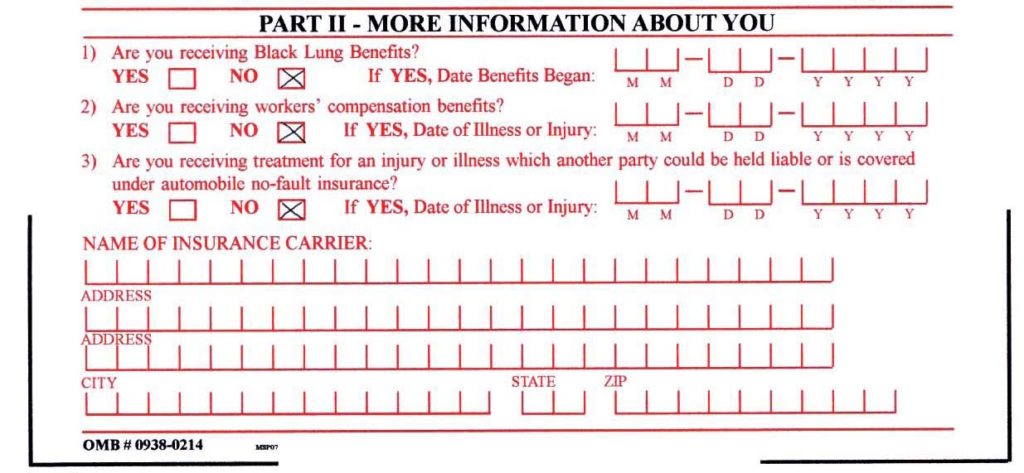

It starts out harmless enough with a request for some general information in Section I. Not bad. So you move on. Below is the second section of this letter. It asks if your client is receiving Black Lung Benefits, worker’s compensation benefits or treatment for an injury or illness which another party could be held liable for or is covered under automobile no-fault insurance. A simple yes or no is all that’s there to choose from.

Then to the left of each of these questions they ask for dates. Sections asking for in depth information about their insurance carrier immediately follow. Most clients answering “Yes” to #3 will probably enter their auto insurance carrier here. Not too bad. But then there’s more. And it gets worse.

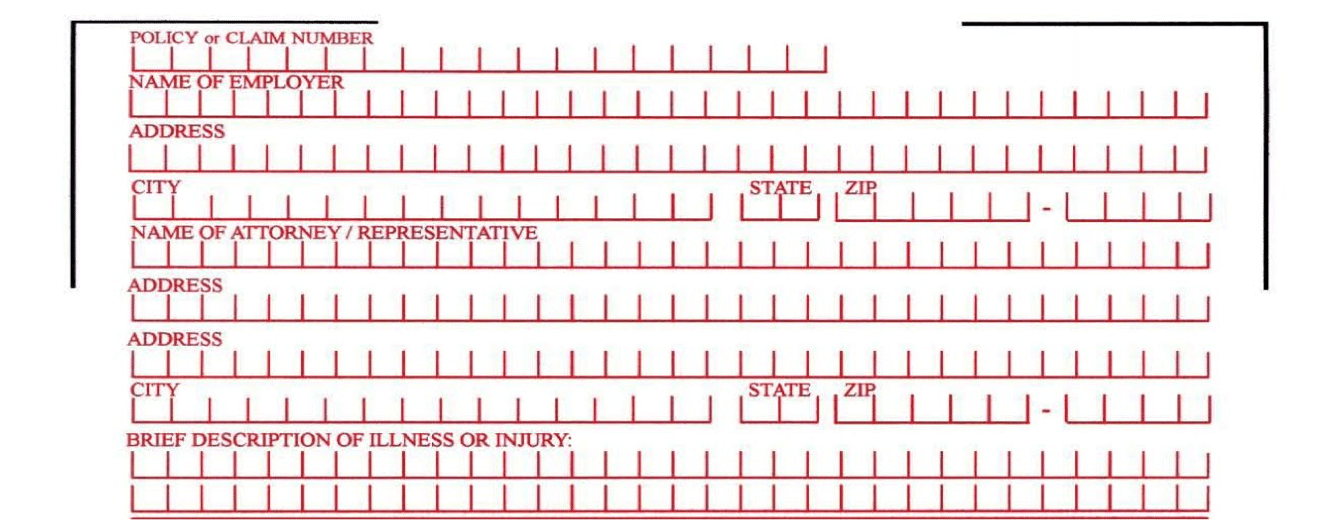

As this section continues to the second page, you’ll notice things go alarmingly in depth. Detailed information about their employer (being disabled and on Medicare, they probably don’t have an employer), their attorney, (that’s YOU), and then a brief description of their illness or injury. All required.

Why does this matter? It matters because Medicare now knows about your client’s settlement. That’s right. Soon, they will have all of the information they need to match bills and deny payments later. This is not good. Really not good. Also, there is no way to get out of this.

What This Means

Now you realize, eligible or not at time of settlement, you’re not safe. Medicare will find out about your client’s settlement. And when they do? They will not pay for future expenses. In fact, they will cut off your client’s Medicare benefits for those conditions and injuries. Those that are the subject of the settlement of your client’s claim. What does this mean for your client? Less funds for other needs. Unless proper settlement planning has occurred from the beginning. Or, it could mean that your client has already spent their settlement. Meaning that they have no money left with which to pay denied Medicare bills. What does this mean for you? At the very least, an angry phone call. If your client is being crushed under a pile of denied Medicare bills, possibly a bar complaint. Or worse, a malpractice claim.

The Solution

Neither of these are good. But there is a solution. It involves looking at an MSA as a useful tool instead of a dangerous weapon. In fact, a “strategically-allocated” and administered custom MSA account, minimized to the lowest reasonable (and therefore, defensible) dollar amount possible, may be your protection-seeking client’s best defense against not having the money to pay denied Medicare bills. The additional benefit? Your client may have effectively “capped” their exposure to Medicare. More importantly, at the amount that is ultimately funded into their MSA.

What if your client does nothing in the way of considering Medicare’s “interest?” Or protecting the Medicare Trust Fund from becoming a primary payer on their settlement-related medical bills? Then, Medicare may take the position (as they do in Worker’s Comp cases) that your client must prove that they have spent their entire settlement. Specifically, including the amounts they paid you for fees and legal costs, on Medicare-allowable expenses. And guess what? That is before Medicare will jump back in and pay one thin dime.

However, if your client has voluntarily created and funded a custom MSA account, and that account has reached either “temporary” or “permanent” exhaustion (out of money) then good news. By law, Medicare has to cover your client’s settlement-related, Medicare-allowable expenses for up to the rest of their life.

Effectively, this is what it boils down to. In order for your client to get into Medicare’s pocket, they must prove they spent their “entire” settlement (BIG NUMBER) or that they have exhausted a minimized MSA (smaller number). Which do you think your client will prefer?

Let Us Help

Take control of your client’s Medicare issues with the help of The PLAINTIFF’S MSA AND LIEN SOLUTION. Our tools will help you and your client determine whether they have a potential Medicare issue in their future. And, if so, whether they can first use one of our “2 Ways To Avoid an MSA.” If an MSA can’t be avoided and it looks like Medicare could be a problem for your client, they may want to voluntarily fund an MSA account to solve it. Then, our team can create a strategically-minimized Medicare Set-Aside allocation to the lowest possible, reasonable and defensible number. Leaving them with more settlement funds and you feeling like you’ve done everything you can to protect them from this situation.

By now everyone knows that liability settlements do not legally require MSAs. Yet, a strategically-minimized MSA from The PLAINTIFF’S MSA AND LIEN SOLUTION may still be a strategy worth considering. That is, as a means to provide the money to pay your client’s future Medicare-allowable, settlement-related medical bills.

What you don’t know about Medicare reporting and skillful use of MSAs to avoid major client Medicare issues can affect your time, money and reputation. Let us help you through it. The PLAINTIFF’S MSA AND LIEN SOLUTION is here for you. Please visit our website at www.plaintiffsmsa.com or call us with any questions at 888-672-7583.

MORE MONEY FOR CLAIMANTS. LESS STRESS FOR TRIAL ATTORNEYS.