Deferred Compensation for Attorneys

The Power of Deferred Fees

We are excited to announce that we are updating our comprehensive fee deferral guide.

While we work on these improvements, our dedicated team is ready to assist you with any questions at no charge.

Call us at 800–666–5584

This guide was drafted by authors with more than 70 years of collective experience advising on Deferred Fees. Co-authored by Jeremy Babener, NYU Tax L.L.M., former Fellow at the U.S. Treasury’s Office of Tax Policy, and current Chair of the Legal Committee for the Society of Settlement Planners.

The Basics

As a contingent fee attorney you have unique access to the benefits of using a “Deferred Fee,” similar to your clients’ option to use a “structured settlement.” With the arrangement you can achieve many investment goals, including substantial tax savings. There are many options, ranging from conservative to aggressive in their investment approach.

We specialize in advising on the right option, for the right fees, in the right situation. We specialize in explaining the mechanics to you, your client, and your law firm. We specialize in vetting the updated version of every program and product you’d like to consider.

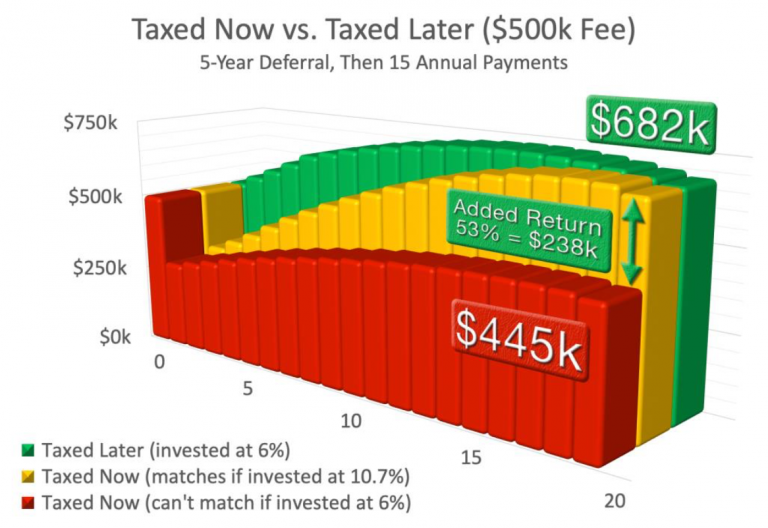

Tax Savings

Deferred Fees offer three major tax benefits. With the right schedule, you can obtain all three:

- You can “spread” your fees over many years to avoid tax rate “spikes.”

- You can delay receiving fees until your lower tax rate years (e.g., retirement).

- You can secure tax-free build-up until payout, like an uncapped Individual Retirement Account.

We’ve helped attorneys obtain these benefits since the U.S. Tax Court recognized this as an effective tax deferral strategy in 1994. Childs v. Commissioner, 103 T.C. 634 (1994), aff’d, 89 F.3d 856 (11th Cir. 1996).

Bankruptcy Protection

Using Deferred Fees can block creditors from the growing investment value of your fees. In fact, though dependent on state law, courts have allowed attorneys to keep their right to Deferred Fees after bankruptcy. The strategy has the added benefit of protecting assets from bankruptcy without using an approach primarily designed to do just that (as opposed to some asset protection trusts).

Investment Opportunities

Deferred Fees offer access to certain unique investment opportunities. Through a Deferred Fee (like a structured settlement) you can fully customize an annuity’s payment schedule – otherwise tax penalties generally apply. We work with claimants and attorneys to leverage that opportunity, minimizing non-invested capital and de-risking portfolios through strategies like dollar-cost averaging (planned buying of an investment with fluctuating value over time). Also, because many highly rated life insurance companies facilitate Deferred Fees, you can diversify fee investments even within standard arrangements.

Depending on the program you use, you can (1) invest in growing markets, (2) borrow against your investments before payout, and (3) “re-defer” payments as you go to maximize the value of the program. Investment options range widely, including money market funds, portfolios for varying risk levels, and name-brand exchange-traded funds.

Client Benefits

If your client is taxable on her recovery, delaying your fees can reduce your client’s taxes. For example, consider a client settling a claim for verbal harassment – claimants are generally taxed on recoveries for non‑physical injuries. Unfortunately, she will be taxed on what she keeps, and also, on what you keep! Spreading your fees out in the future likely helps her avoid the same tax rate “spike” that you avoid through with a structured fee. For the same reason, she should consider a structured settlement for herself. Notably, either one of you, or both of you, can choose to delay receipt of payments.

Make Plans for Your Future

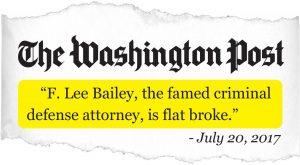

Too many attorneys don’t make adequate plans for their financial future. Here’s a case in point:

Too many attorneys don’t make adequate plans for their financial future. Here’s a case in point:

Want to learn more about deferred compensation? Deferring, or structuring part of your fees to beef up your pension and retirement planning, can be a smart move. Especially, if you choose the right people to help you do it.

Settlement Professionals, Inc. offers an excellent option for trial attorneys wanting to defer some of their compensation.

When you schedule a no-obligation phone consult, we will give you our comprehensive 40-page white paper. Basically, this white paper contains everything you and your tax advisers need to know about this powerful retirement strategy.

Please Note: This Trial Lawyer’s Executive Deferred Compensation Plan is available only to attorney members of your firm, and available exclusively from Settlement Professionals, Inc.

To find out more, and also schedule your no-obligation phone consult, call Settlement Professionals, Inc. at 503-699-8929, or toll free at 800-666-5584.

Want to run a case by us?

We are available Mon-Fri 9am-5pm PST

Phone

Phone

“When it comes to structured settlements, and more importantly, settlement planning for our clients, our trust in Jack Meligan and his SPI team is 100 percent.”

J.R. Crockett & Rich Myers, Esqs.

The Law Office of Crockett & Myers

“Jack is always helpful, professional and committed to doing the very best possible for our clients on many different occasions.”

Michael A. Greene

Rosenthal & Greene, P.C. (Portland, Oregon)